Feds to Spend Two Trillion to Keep Three Trillion Dollar Banking System From Collapsing?

This article is sponsored as a public service of the Worldview Weekend Foundation. Thank you for your contribution to www.wvwfoundation.com

so we can continue to offer this FREE service.

You can also send your contribution to:

Worldview Weekend Foundation

P.O. Box 1690

Collierville, TN 38027

Click here and visit www.wvwtvstore.com to order emergency, freeze-dried food that will last 25 years and vital emergency supplies or call 901-468-9357.

Protect Your Assets Now!!

Get your free, no-obligation packet on precious metals by texting or calling Wes Peters with Swiss America at 602-558-8585

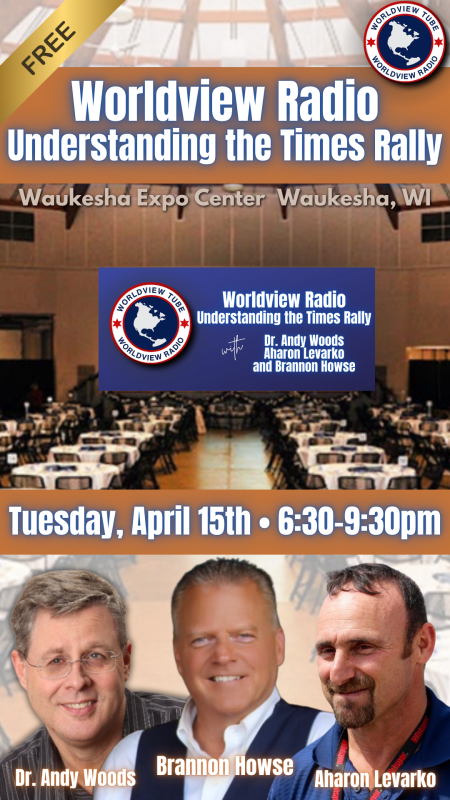

In a recent interview with TV host Brannon Howse, lawyer and economist Rebecca Walser delved into the complex world of finance and the alarming state of the U.S. banking system. The conversation shed light on the M2 money supply, the Federal Reserve's actions, and the potential crisis that could loom on the horizon.

What is the M2 Money Supply?

Rebecca began by explaining the concept of the M2 money supply, describing it as everything that can be readily converted into cash. It encompasses not just liquid cash but also checking and demand deposits and other instruments quickly convertible to cash.

As the discussion unfolded, it became apparent that the U.S. banking system was facing challenges that extended far beyond the definition of M2 money.

The Banking Crisis Amid Economic Slowdown

The interview began by highlighting a headline from Reuters, which stated that U.S. banks hold a staggering $3.3 trillion in cash amid a banking crisis and economic slowdown. The crucial question posed was, "Why are banks holding such a significant amount of cash when the Federal Reserve has been injecting massive sums into the banking system to prevent collapse?"

Rebecca's detailed analysis revealed the underlying issues within the banking system. She explained that banks had shifted their strategies away from traditional lending and instead were heavily investing in U.S. treasuries, seeking safer returns for depositors. However, this seemingly safe approach has its perils.

The Impact of Rising Interest Rates

One of the key factors contributing to the banking crisis is the rapid increase in interest rates. As the Federal Reserve has raised rates multiple times since April of 2022, it has triggered a significant impact on the value of the treasuries held by banks.

Rebecca clarified that there is an inverse relationship between the value of bonds and interest rates. When interest rates rise, the value of existing bonds falls. In the case of banks holding treasuries as assets, the rapid increase in interest rates has led to a substantial reduction in the value of those assets.

The Federal Reserve's Backstop

To mitigate the looming banking crisis, the Federal Reserve has implemented the Bank Term Funding Program (TFP). This program essentially acts as a backstop, providing support for two-thirds of the $3.3 trillion in cash held by U.S. banks.

Rebecca underscored the gravity of the situation, emphasizing that this is the most precarious position the U.S. banking system has faced since the Great Depression. The crisis has prompted individuals to withdraw their deposits from banks and seek alternative investments, including precious metals and real estate.

The Complexity of the Issue

Throughout the interview, it became evident that the intricacies of the banking crisis and the actions taken by the Federal Reserve are not widely understood by the American public. Rebecca estimated that only around 1% of Americans grasp the complexity of these financial issues.

The conversation emphasized that the banking crisis is a multifaceted problem, with far-reaching consequences. The shift from traditional lending to Treasury investments and the impact of rising interest rates have left the U.S. banking system on the brink of a severe crisis.

Conclusion

The interview with Rebecca Walser offered a rare glimpse into the complexities of the U.S. banking system and the challenges it faces. As the Federal Reserve attempts to prevent a catastrophic collapse, the American public is left largely unaware of the gravity of the situation.

Understanding the intricacies of the M2 money supply, the consequences of rising interest rates, and the Federal Reserve's actions is crucial for anyone concerned about the stability of the U.S. financial system. The banking crisis looms large, and its resolution will have significant implications for the nation's economic future.

Click here to watch this program now:

https://www.worldviewweekend.com/tv/video/feds-spend-two-trillion-keep-three-trillion-dollar-banking-system-collapsing

This article is sponsored as a public service of the Worldview Weekend Foundation. Thank you for your contribution to www.wvwfoundation.com so we can continue to offer this FREE service.

You can also send your contribution to:

Worldview Weekend Foundation

P.O. Box 1690

Collierville, TN 38027

Click here and visit www.wvwtvstore.com to order emergency, freeze-dried food that will last 25 years and vital emergency supplies or call 901-468-9357.

For a free, no obligation packet of information on precious metals or putting gold into your IRA please text your name and address to Wes Peters of Swiss America or call him at 602-558-8585.

This article is sponsored as a public service of the Worldview Weekend Foundation. Thank you for your contribution to www.wvwfoundation.com so we can continue to offer this FREE service.

You can also send your contribution to:

Worldview Weekend Foundation

P.O. Box 1690

Collierville, TN 38027

Trending Stories

WE'RE A 100% LISTENER SUPPORTED NETWORK

3 Simple Ways to Support WVW Foundation

Make Monthly Donations

-or-

A One-Time Donation

-

Mail In Your Donation

Worldview Weekend Foundation

PO BOX 1690

Collierville, TN, 38027 USA -

Donate by Phone

901-825-0652